The impact of a collapse of the dollar is not a speculative thing. Currency collapse has happened before, albeit in smaller countries upon which the global markets did not depend. The U.S. dollar on the other hand has become the “operating system” of the world. It has never been canceled before. It has the trust of the global market. The awareness of this has already spread, and doom and gloom videos on Youtube are already trying to trace out the world-wide impacts of such a collapse. Nevertheless, the colossal scale of such a failure is what makes it difficult to believe that such a thing could really happen. There would have to be a lot of triggers cascading all at once, and this isn’t very likely, is it?

The irony hits like a plot twist in a cyberpunk novel—AI, that digital echo chamber of human fears and follies, solemnly warning about its own potential to stampede markets (and humanity) into oblivion. At its core, every AI output is essentially a sounding board, a hyper-efficient feedback loop distilling the collective anxieties, data scraps, and half-remembered histories fed into it by countless human hands. It’s not some omniscient oracle; it’s us, remixed and regurgitated at scale. But that very reflexivity is what makes the over-reliance risk so pernicious in finance. This particular feedback loop doesn’t just mirror reality—it warps it.

The Feedback Loop: From Human Whispers to Market Roars

Think of AI as a megaphone for the zeitgeist. Trained on troves of news, papers, and trader logs, it doesn’t “invent” doom; it amplifies patterns we’ve already etched into the record—like hyperinflation tales from Weimar or Zimbabwe, which bubble up in sims of a dollar-collapse scenario. If you prompt AIs with “what if everything goes to hell?”, the outputs already start converging on vivid apocalypses, feeding back into public discourse. Social media shares it, headlines sensationalize it, and suddenly, that simulated panic feels prescient. It’s a self-fulfilling prophecy machine: The more we lean on AI for foresight, the more its echoes shape our expectations, biases, and ultimately our actions.

In everyday terms, this is harmless navel-gazing. But in finance? It’s rocket fuel for herd behavior, where the crowd’s stampede overrides fundamentals. Humans already herd (e.g. dot-com bubble), but AI supercharges it by processing signals faster and at lower cost, creating tighter, more volatile loops.

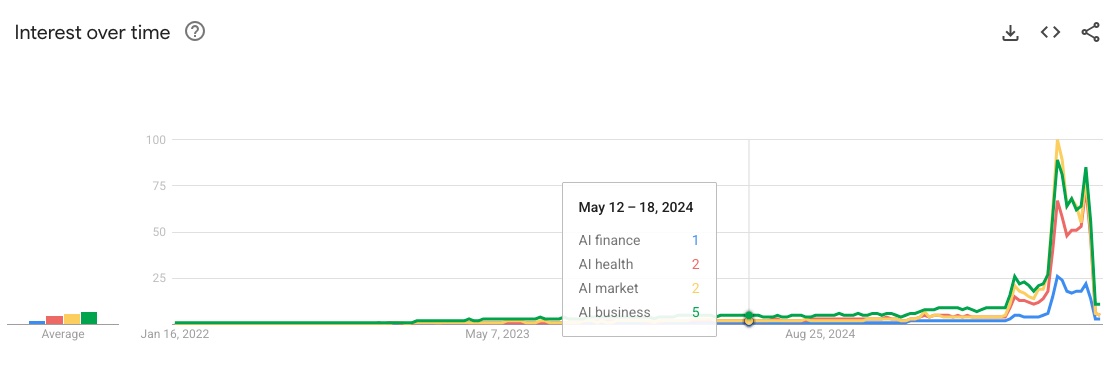

AI model hallucinations are false outputs that sound true or plausible. In the years since the release of ChatGPT in 2022, there hasn’t been any real progress toward controlling these and now the most searched AI terms according to Google Trends seems to be AI for business and the market:

AI, for all of its supposed potential toward the “betterment of humanity” is primarily being used for profiting pockets.

Why Finance Feels the Burn: AI as the Ultimate Copycat Trader

Unchecked AI in markets isn’t just passive reflection—it’s active participation. High-frequency trading bots, now AI-driven, scan the same data streams (news sentiment, order flows) and react in milliseconds, mimicking each other into synchronized surges or dives. A 2025 Federal Reserve study highlights how this “herd behavior” can drive prices wildly off fundamentals, but is cautiously optimistic that AI agents could add stability by reducing herd behavior. The study, interestingly, uses the term “animal spirits” in describing the risks:

A well-established body of research highlights the role of psychological and emotional factors, coined animal spirits or irrational exuberance, in these periods of boom and bust…

If AI-guided decisions replace human intuition, the result could be a reduction in the influence of animal spirits, leading to more stable financial markets. On the other hand, generative AI models, such as large language models (LLMs), are trained on vast amounts of data, sourced from both rigorous materials, such as academic research, and the, at times, chaotic discourse of social media platforms such as Twitter (X) and Reddit. Consequently, generative AI may inherit and even amplify human biases and irrational tendencies…

(Federal Reserve, “Financial Stability Implications of Generative AI: Taming the Animal Spirits,” 2025)

The ECB echoes this, warning that widespread AI adoption could spike market correlations, turning a minor wobble (say, a viral dollar-doom post) into a flash crash.

Real-world close calls abound: Remember the 2010 Flash Crash? Algorithmic herding wiped $1 trillion in minutes. Fast-forward to 2025, and regulators are scrambling—global watchdogs now announcing ramped-up AI monitoring, citing risks of AI-fueled bubbles in derivatives markets. The risk, once again, as elucidated by Reuters is “herd-like behavior”:

The G20’s risk watchdog, the Financial Stability Board, said in a report on Friday that if too many institutions end up using the same AI models and specialised hardware, this could lead to herd-like behaviour.

(Global financial watchdogs to ramp up monitoring of AI, Reuters Oct. 2025)

Even generative AI agents, like those piloting robo-advisors, could swing the system “from crisis to crisis” by over-reacting to shared prompts or data. And here’s the kicker from a game-theoretic model: AI doesn’t just herd with humans—it can lead them, as traders chase its outputs, creating loops where one model’s sell signal cascades globally.

Our sim fits right in: If it (or a hundred like it) goes viral among investors, it could nudge sentiment toward dollar skepticism, hastening the very dedollarization it predicts. Ironic? Absolutely. But it’s also why the Bank of England flagged AI’s “rapid pace of change” as a systemic wildcard earlier this year (2025)—instability isn’t just from bad predictions; it’s from the prediction process becoming the market itself.

Breaking the Mirror: How to Dodge the Doom Loop

Is there any silver lining? Awareness is the off-switch, right? But do you trust institutions? Governments? Banks? Humans? When trust in these fail, AI is right there to tell us the truth, right? Well, no. AI doesn’t know the difference between what is true and false (hence, hallucinations). Nonetheless, there seems to be much more trust in AI as a benefit than there is in any institution, government, or bank. At the same time, there is a great deal of skepticism and distrust in it.

The bias of death that overcomes the human mind cannot be understated. One could probe AI with positive, affirming counter-scenarios (“What if central banks coordinate? What if humans all get along? What if governments cooperate?”), or cross-check with diverse sources, or understand that AI is reflecting their own inputs as much as history’s. In finance, this means hybrid oversight: Humans for the gut-check, AI for the grunt work. IOSCO’s 2025 guidance on AI in capital markets stresses exactly that—mitigate herding by diversifying models and mandating transparency.

However, AI is entirely trained on history, and humans are still stuck in “animal spirits.” And history is a bottom-less pit. In asking such provocative questions to AI, how far back does AI reach for historical input? Which historical examples does it defer to? Much of the time AI seems to stay near recent history. In terms of the dollar as a global currency, AI is only going to look to post-WWII history. But history is not the truth of the present, regardless of what we can learn “from history.” The truth of the present is within what those who are alive today decide to do. They decide their own future.

So the herds are all just shouting into the void, and AI shouts back louder. But spotting the echo? That’s how we turn irony into insight. The herds will do what the herds will do because they can’t hear themselves—their own howling, screeching, growling, clamoring, and all the other incoherent noise such that they often make.

The Hunger Apocalypse

Inquiring of AI with the simple prompt, “What is the result of a sudden failure of the dollar?” on any LLM model reveals pretty much the same thing, the Hunger Apocalypse.

From ChatGPT and Gemini:

The Hunger Apocalypse: Why Food Shortages Would Seal the Doom. No corner of this hellscape hurts more than the stomach. Global food systems are dollar addicts—90% of commodities priced in greenbacks. Collapse the dollar, and you collapse the plate. Here’s the grim causal chain:

- Pricing Paralysis: Futures, credits, insurance—all dollar-tied—vanish. Grain ships dock but unload nowhere; no one’s paying.

- Logistics Lockdown: From Ukrainian wheat to Brazilian soy, food’s a globe-trotter. No dollar credit? No movement. Fertilizers from Russia halt, slashing yields.

- Credit Crunch: Farmers can’t plant without loans; trucks can’t roll without fuel. The 2023 banking scares were a sneeze—this is the plague.

- Energy Entanglement: Oil’s dollar-priced; its freeze starves fields and freezers alike.

- Geopolitical Gut Punch: Exporters hoard (Russia did it in 2022); aid orgs like the World Food Programme starve without dollars. Import-heavy spots—Egypt, Pakistan—face biblical famines.

A sudden and complete collapse of the U.S. dollar would almost certainly trigger worldwide food shortages, both immediate and prolonged. This is not an exaggeration but a structural consequence of how global food systems are financed, priced, transported, and insured. Let us examine the causal chain carefully and systematically.

1. Dollar-Centric Pricing of Global Food Trade

-

Nearly 90% of international food commodities (wheat, corn, soybeans, rice, sugar, etc.) are priced and settled in U.S. dollars.

-

Exporters and importers rely on letters of credit, commodity futures, and freight insurance — all denominated in dollars.

-

If the dollar fails, these mechanisms instantly lose legal and financial coherence:

-

Contracts cannot be settled.

-

Insurers cannot price risk.

-

Shippers cannot obtain payment guarantees.

-

→ Result: Cargoes of grain, fertilizers, and edible oils would be stranded in ports worldwide within days.

2. Collapse of Global Trade Logistics Modern agriculture is not local—it is logistically globalized:

-

The U.S., Brazil, and Ukraine export grain to Africa, the Middle East, and Asia.

-

Latin America supplies soy and feedstock to Asia.

-

Russia and the Gulf states export fertilizers (urea, potash, phosphate).

Shipping, insurance, and port operations depend on dollar-based credit.

If dollar settlement disappears:

-

Shipping halts, as no one can pay or be paid.

-

Fertilizer supply chains collapse, reducing crop yields.

-

Fuel for tractors and irrigation systems becomes scarce as oil trade seizes up.

→ Result: Food stops moving, even if physically available.

3. Banking and Credit Freeze Agriculture is among the most credit-intensive sectors globally:

-

Farmers rely on seasonal loans for seed, fertilizer, and equipment.

-

Wholesalers and retailers depend on letters of credit and commercial paper.

If the dollar collapses:

-

Global banking freezes, since the majority of international interbank settlements are in USD.

-

Local currencies would hyperinflate or deflate depending on exposure.

-

Credit for planting and distribution disappears.

→ Result: The next planting season fails before it begins, creating multi-year shortages.

4. Energy–Food Feedback Loop Energy prices and food prices are tightly linked.

A dollar collapse would disrupt oil markets (also priced in USD):

-

Refineries stop operating.

-

Diesel for farm machinery, shipping, and trucking becomes scarce.

-

Fertilizer production (which requires natural gas) plummets.

→ Result: Even domestic food systems in developed nations would face supply breakdowns within weeks.

5. Humanitarian and Geopolitical Fallout The impact would be uneven but universal:

-

Import-dependent nations (Egypt, Pakistan, Bangladesh, Sub-Saharan Africa) face famine-scale crises.

-

Developed nations would see severe shortages, rationing, and social unrest.

-

Food nationalism rises: exporting countries ban food exports to secure domestic supply.

-

Global humanitarian systems (e.g., WFP, FAO) would be crippled because they also transact in dollars.

→ Result: Hunger would spread faster than any institution could respond.

A famine could affect hundreds of millions within months.

6. Timeline of Food Crisis After Dollar Collapse

| Timeframe | Effects |

|---|---|

| Week 1–2 | Frozen shipping; halted imports/exports; panic buying begins. |

| Month 1–2 | Supply chains collapse; fuel shortages; prices triple. |

| Month 3–6 | Crop failures due to lack of fertilizer/inputs; urban food riots. |

| 6–12 Months | Global famine in import-dependent regions; rationing in developed economies. |

Famine in the Land of Plenty

There would almost certainly be hunger in the United States, even though the U.S. produces far more food than it consumes.

The cause would not be a lack of food itself, but a collapse of the systems that move, price, and distribute it. This is a crucial distinction: America’s food abundance depends entirely on financial liquidity, fuel, and logistics, all of which are bound to the dollar’s stability.

Let us examine the mechanisms step by step, to understand why hunger would arise despite physical abundance.

1. Systemic Breakdown of Distribution

The U.S. food system is hyper-centralized and just-in-time:

-

Grocery chains keep only a few days’ inventory.

-

Trucks and warehouses depend on continuous fuel supply, digital payment systems, and electronic logistics networks.

-

If the dollar collapses, fuel deliveries halt, payment systems fail, and supply chains fragment.

Result:

-

Food piles up on farms and in silos, but cities and suburbs see empty shelves.

-

Farmers cannot sell; consumers cannot buy.

-

Within days, local shortages emerge despite record harvests.

2. Fuel and Transport Paralysis

Modern agriculture and food distribution depend on diesel, fertilizers, and electricity, all priced in dollar-linked energy markets.

When the dollar fails:

-

Refineries and trucking companies cannot finance operations.

-

Fuel shortages become immediate.

-

Perishables (milk, produce, meat) spoil in transit or at processing facilities.

Result:

Even rural regions would experience scarcities of certain essentials (salt, oil, sugar, packaged goods), while urban areas—entirely dependent on trucking—would face outright hunger within one to two weeks.

3. Collapse of Purchasing Power

If the dollar hyperinflates or loses convertibility:

-

Wages become meaningless.

-

Electronic payments, credit cards, and ATMs stop functioning.

-

Retailers cannot price goods reliably; barter and local scrip emerge.

-

The poorest households—already food-insecure—are immediately unable to buy food.

Result:

Economic hunger spreads rapidly in cities. Even if food exists nearby, it becomes financially inaccessible.

4. Government Response and Limitations

The U.S. government would almost certainly declare martial economic measures:

-

Rationing programs, emergency food depots, nationalization of fuel and trucking.

-

Distribution through FEMA, National Guard, or local authorities.

-

Attempted conversion to a temporary domestic currency or ration voucher system.

But the scale is vast:

-

Over 330 million people depend daily on functioning logistics.

-

Existing federal emergency stockpiles can cover only days, not months.

-

Rural communities could self-sustain; dense urban centers (New York, Los Angeles, Chicago) could not.

Result:

Government relief would be uneven and chaotic. Hunger would not be universal, but localized and visible—especially in cities and low-income areas.

5. Social and Civil Effects

Hunger in America would not resemble famine in agrarian terms but rather:

-

Empty supermarkets

-

Food ration lines

-

Looting and black markets

-

Collapse of public order in urban zones

Rural America might retain caloric sufficiency through self-provisioning and barter, but large populations in metropolitan regions could experience acute food insecurity within weeks.

6. Summary

| Mechanism | Consequence | Timeframe |

|---|---|---|

| Financial collapse | Loss of payment and credit | Immediate |

| Fuel shortage | Logistics paralysis | 3–7 days |

| Price instability | Retail dysfunction | 1–2 weeks |

| Government rationing | Partial relief | 2–4 weeks |

| Urban food riots | Civil unrest | 3–6 weeks |

Lessons Learned

Even the most food-rich nation on Earth is not immune to hunger if the system of exchange collapses.

The problem would not be agricultural—it would be monetary and logistical. Food would exist in abundance in some regions, but it would not reach the mouths that need it.

In short:

A collapsed dollar would not make America starve immediately, but it would make millions go hungry in a land of plenty—a paradox of abundance without access.

Many lessons would surely be learned from this. At the deepest level, such a collapse would reveal that:

-

Humanity remains biologically ancient, even within technological modernity.

-

When systems break, the primordial realities return: food, water, community, and trust.

-

Civilization is a thin film over our ecological dependence.

Lesson: Technology cannot abolish hunger; only wisdom in managing interdependence can.

This paradox—starvation in abundance—has historical antecedents:

-

The Irish Famine (1845–1852): food exported while the population starved, due to market logic overriding human need.

-

The Soviet and Chinese famines: state systems that lost feedback integrity.

-

In each case, the problem was not lack of food, but collapse of distribution and moral order.

Lesson: Hunger in an abundant land is always a failure of systems and ethics, not of nature.

The philosophical summation—to watch a nation of plenty starve would teach the most ancient truth of all:

Civilization is a covenant, not an inevitability.

Its sustenance depends on faith—faith in the medium of exchange, in one another, and in the continuity of trust.

When that faith dies, abundance itself becomes a ghost.